| Uploader: | Herc |

| Date Added: | 22.01.2019 |

| File Size: | 72.30 Mb |

| Operating Systems: | Windows NT/2000/XP/2003/2003/7/8/10 MacOS 10/X |

| Downloads: | 42897 |

| Price: | Free* [*Free Regsitration Required] |

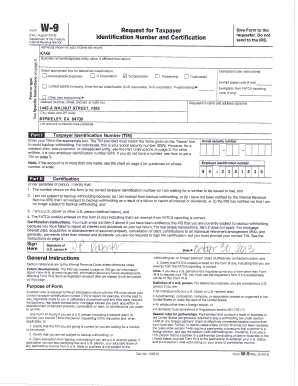

IRS W-9 Form - Free Printable, Fillable | Download Blank Online

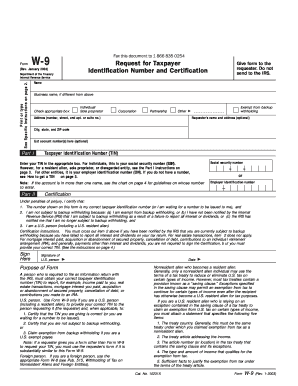

Jan 09, · Information about Form W-9, Request for Taxpayer Identification Number (TIN) and Certification, including recent updates, related forms, and instructions on how to file. Form W-9 is used to provide a correct TIN to payers (or brokers) required to file information returns with IRS. Form W Instead, use the appropriate Form W-8 or Form (see Pub. participating foreign financial institution to report all United States , Withholding of Tax on Nonresident Aliens and Foreign Entities). Nonresident alien who becomes a resident alien. Generally, only a nonresident alien individual may use the terms of a tax treaty to reduce. To download the form from the Chrome web browser: Click the link to the Form I-9 you wish to download. Click the arrow that displays in the PDF file download box that will appear in the bottom left-hand corner. Select “Show in folder” from the drop-down menu that appears. Open the form that appears in your Download folder.

W 9 form download pdf

The W-9 Tax Form is one of the easiest reports to fill out. You've probably already heard about it, but let's delve into it in a little more detail and analyze all the essential information. This form is meant to be prepared by freelance workers and other taxpaying residents of the U. According to the IRS website, you are considered a resident for federal tax purposes if you can relate to the following:.

The W-9 report is a basic doc for ICs or freelancers, including business-consultants, trade workers and those who hire them. The data is meant to be used on a Information Return. Those who are self-employed use it to avoid backup withholding. If you sign this template on behalf of the organization, you must confirm that you are authorized to sign. You can get the necessary blank template from your employers or download it for free. But in order to prepare the document correctly and without errors, we recommend using an online sample.

There should be no corrections. If you make a mistake when filling out the sample manually, you will need to start all over again, including the print process. However, this is a waste of time and paper. Electronic filing is more convenient. The W-9 sheet components contain appropriate lines for your answers. You can easily replace incorrect information in an editable document online at any time. Moreover, you can complete this web-based sample from any device and e-sign it in seconds. Our step-by-step free instructions will help you to fill out the blank W-9 Form faster than ever before.

Enter your full name the same as it's presented on your personal income tax return or the corporate name. Keep in mind, if you change your name you must inform the SSA.

This field must be filled in and not left blank. If you have specified the name of the juridical body in the first line, you do not need to repeat it again. Fill it in only if your business w 9 form download pdf legal name are different.

You can also leave this field empty if you are working on your own behalf as a sole contractor but not on behalf of the company or partnership. Only one variant should be chosen in this column. W 9 form download pdf not, choose another appropriate federal tax category. In case you have the Other type, see the instructions. This box is not the obligatory one, but fill out if applicable. Usually, private contractors have no exemptions of additional retention.

However, corporations could be exempt. If you have any questions, seek independent tax advice. If your legal address does not match your place of residential real estate, use the one you put on your tax return.

It is not an obligatory field. Remember that the IRS Form W-9 will only apply to the mentioned account, and you will need to provide another record for your other accounts. The fillable W-9 is for people who must file an information declaration to obtain the TIN of the recipient of payments or another person to avoid backup withholding. You will have 60 days to provide your TIN numbers to the Bank. Please sign these papers and enter the date. If you sign the W-9 tax form on behalf of a legal entity, you must confirm that you are authorized to set the signature.

You can sign electronically. The online PDF editor allows you to create your customized legally binding eSignature. The W-9 tax forms were created by the federal government and are used by company entities you work with to receive information w 9 form download pdf your tax status.

Once completed, the form will be sent directly to the company you cooperate with, w 9 form download pdf, not to the IRS. According to tax classification, w 9 form download pdf, you can be the subject to backup withholdings if you didn't respond to the request for taxpayer identification, w 9 form download pdf. Businesses need this information to know which tax to deduct from your payments if necessary and to submit the appropriate tax forms to w 9 form download pdf tax authorities on your behalf.

In compliance with the definition of Revenue Service, an independent contractor is a person, corporation or business to present the work when only the result is under control, not all the actions and the process. For your convenience, w 9 form download pdf can use the free online sample. An advanced PDFfiller editor offers a set of powerful tools to quickly complete the fillable W-9 form from any device.

Moreover, w 9 form download pdf, this electronic sample is more secure than filling out a paper one. So your confidential information is protected and stays safe. The preparing and signing process takes minutes and afterward you can email, print or download the file to use in the future. Many recipients send this form to payers each year to give them current evidence about the individuals and businesses they deal with.

Online alternatives allow you to to organize your doc management and enhance the efficiency of your respective workflow. Abide by the fast information to be able to finished IRS W-9 Formrefrain from errors and furnish it inside a well timed way:. PDF editor will allow you to make alterations to your IRS W-9 Form from any internet linked system, customize it based on your needs, indicator it electronically and distribute in several methods. W-9 Form. Get W 9 form download pdf. According to the IRS website, you are considered a resident for federal tax purposes if you can relate to the following: Individual citizen or foreigner who permanently resides in the country.

A legal entity such as a company, partnership or corporation established or started up in the U. An inheritance fund except foreign. National trust fund. Keep in mind not to submit the W-9 to the IRS. Submit it only to the requester. Did you know? What are the Components of a W-9 Form? BOX 1 Enter your full name the same as it's presented on your personal income tax return or the corporate name.

BOX 2 If you have specified the name of the juridical body in the first line, you do not need to repeat it again. BOX 3 Only one variant should be chosen in this column. BOX 5 Start to enter your address. For example, Princeton Ave, apt BOX 7 It is not an obligatory field. Note: A valid U.

A TIN should not be used as a taxpayer identification number if it: Contains anything other than numbers. Contains more or less than 9 digits. Comprises 9 identical digits. Consists of 9 consecutive numerals in ascending or descending order. Pay attention to the certification instructions on the page. Conclusion The W-9 tax forms were created by the federal government and are used by company entities you work with to receive information about your tax status.

Use the clues to complete the relevant fields. Include your own information and phone data. Make confident which you enter right info and figures in best suited fields. Carefully take a look at the subject matter in the type as well as grammar and spelling.

Refer to assist area in case you have any queries or deal with our Guidance workforce. Once the form is concluded, press Executed. Distribute the all set type by way of electronic mail or fax, print it out or help you save with your device.

FAQ Do influencers usually complete W-9 forms? How do brands expense influencer marketing expenses? For US influencers, a integrated W9 form can be downloaded, filled out, and attached, w 9 form download pdf.

Influencer contracts are used less w 9 form download pdf less but are imperative for certain campaign types, such as events. If a campaign is paid, usually a simple collaboration quote will be agreed upon by the brand or agency.

These quotes briefly outline the date and details of publication dedicated hash tags, sharing instructions, etc as well as the price per post.

Though if the campaign features an event, it is strongly advised to create a specific contract. What does a professional Influencer contract look like? Examples here. To conclude, it is advised to use contracts when the partnership circumstances require it: either for brand safety confidential information or to confirm the presence of an Influencer at an event.

Answer based on my experience with Upfluence. You can try out our influencer search engine for free here. Hope this helps! Why does our customer need us to provide a W-9 form? Why is my customer asking for Form W-9?

How To Sign A w9 Online for Free - Electronic Signature

, time: 5:10W 9 form download pdf

To download the form from the Chrome web browser: Click the link to the Form I-9 you wish to download. Click the arrow that displays in the PDF file download box that will appear in the bottom left-hand corner. Select “Show in folder” from the drop-down menu that appears. Open the form that appears in your Download folder. Inst W Instructions for the Requestor of Form W-9, Request for Taxpayer Identification Number and Certification 10/29/ Form W-9 (SP) Solicitud y Certificacion del Numero de Identificacion del Contribuyente 11/07/ Inst W-9 (SP). Form W-9 (Rev. ) Page 2 The person who gives Form W-9 to the partnership for purposes of establishing its U.S. status and avoiding withholding on its allocable share of net income from the partnership conducting a trade or business in the United States is in the following cases: • The U.S. owner of a disregarded entity and not the entity.

No comments:

Post a Comment